Catching the fever:

Trading has always seemed like something only professionals do — the type of thing you see in movies with lots of flashing screens and complex charts. But when I decided to explore the world of trading for myself, I quickly realised: you don’t have to be a professional to start — you just have to be willing to learn, step by step.

A recent conversation with a childhood friend, Moses, gave me new ideas. Later, I spoke again with another very good childhood friend of mine, (Mr Pee) Pius Anokwu, who has been involved in trading for some time. Whenever time permits, we talk — among other things — about trading. There were also a few colleagues at work who engaged in meaningful conversations about trading and were always willing to explain a few concepts when I asked.

Other happenings — my tech journey, random Facebook and Instagram ads — kept nudging me toward it. And the idea that I could enhance my IT learning by building an automated trading dashboard really set me on the path.

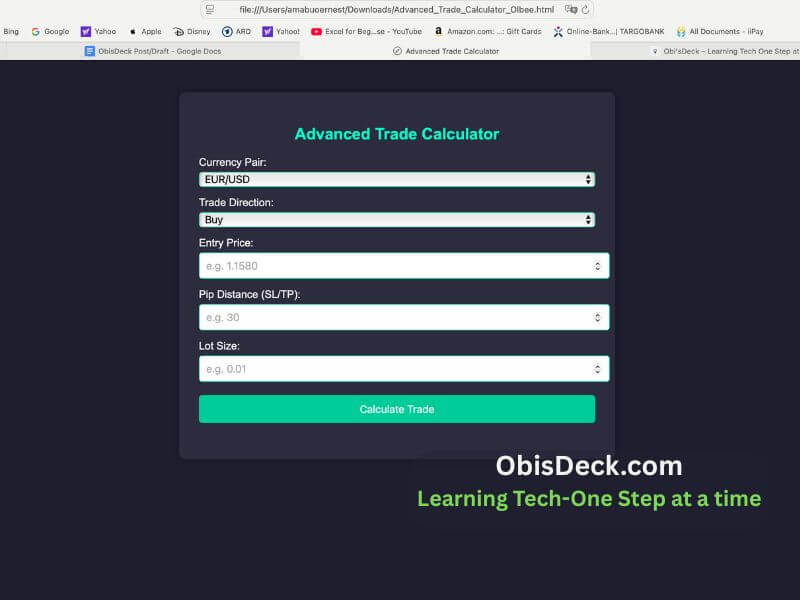

So, over the past few weeks, I’ve been diving into trading using MetaTrader 5 and setting up a proper trading journal. I also began building simple tools — like a pip calculator — and practicing with a demo account through Admiral Markets.

Why I Decided to Learn Trading

Information about trading has always been around me. I’m not talking about the get-rich-quick ads on Facebook or Instagram that push you toward buying strategies or courses. I’m talking about real trading insights: strategies, deeper understanding, the risks and the potential gains.

Conversations with a few people, as I mentioned, helped set me on this path. But the final spark was the possibility of taking structured steps and learning by building pip calculators, trading journals, and tools — all leaning toward automation, which is part of my broader IT learning journey.

This is also part of my pursuit of new ways to generate income. I wanted something that:

✅ Is flexible (I can trade even with a full-time job)

✅ Can be scaled over time

✅ Gives me full control — no one manages my money but me

Trading matched these goals — but I knew it also came with risks. That’s why I committed to learning first, not rushing.

Lessons From My First Trading Weeks

A Trading Journal Is Essential

Keeping records of each trade (what I saw, why I entered, what happened) helps me learn much faster than just guessing or jumping in blind.

I used to think trading involved everything but skill. Now I know that “luck is the intersection between preparation and opportunity.” You must learn the “waltz and foxtrot” of it all. Commit to a deeper learning of the process and extricate yourself from emotions that come with it while focusing on technical and fundamentals of the entire exercise.

Understanding Risk-Reward

Using a clear R:R (Risk-to-Reward) ratio for every trade helps me protect my account and avoid emotional trading.

Building Tools Helps Learning

Creating my own pip calculator in JavaScript has taught me more about pip size, SL/TP, and pair differences than any YouTube video could.

While I don’t underestimate the importance of good YouTube videos on trading, one should be able to localize what is learned — by taking from them and building tools that work for you.

What I’m Working On Next

✅ Testing small demo trades using my tools

✅ Learning more about using technical indicators (RSI, Moving Averages)

✅ Improving my Google Sheet trading dashboard

✅ Exploring automation possibilities (APIs, Zapier)

✅ Continuing to journal every step — wins and mistakes

Final Thoughts: Trading Is a Journey, Not a Race

If you’re new to trading like me, here’s my advice:

Don’t try to “beat the market” overnight.

Start with learning, take notes, build your tools, and track your progress.

This is exactly what I’m doing — and I will continue to share both my wins and mistakes as I go.

Stay tuned for more — and if you’re on a similar learning path, let’s connect!